Causes of Inflation

The COVID-19 pandemic has put a dent in many industries that are considered a necessity. Many factors contribute to the rise in prices for goods like construction materials, and services creating a significant increase in the cost of production. As we get through the pandemic, HH Insurance breaks down the key points you need to know about inflation, the housing market, and the effect on home insurance Florida.

How Inflation Increases the Price of Claims

Your insurance company takes several factors into consideration when calculating your rate or premium. These factors differ for every company but generally, your rate will depend on the location of the property, your credit rating, and the property type. Furthermore, your home insurance Florida rate is also based on the amount of coverage you want for your property. At HH Insurance, we analyze all of these factors in addition to the age of your home and if the condition of the roof is in compliance with current building codes.

Many aspects of homeowner’s insurance have shifted to reflect the surge of inflation caused by the COVID-19 pandemic. According to the National Association of Home Builders, the average cost of a single-family home has increased by nearly $30,000 since the early pandemic stages in April 2020.

That being said, here are the most important facts that are causing your home insurance to rise.

- Increase of prices for goods and services

- Global construction supply shortages

- Increase in production costs

- Increase in demand

Let’s Talk Numbers

Since the beginning of the pandemic, we have witnessed many changes in our society and its economy. Our closest communities have had to adjust to the new normal and endure pricing fluctuations on nearly every item. For home insurance Florida, the inflated rates on production along with a shortage of supplies directly impact homeowners and their insurance rates.

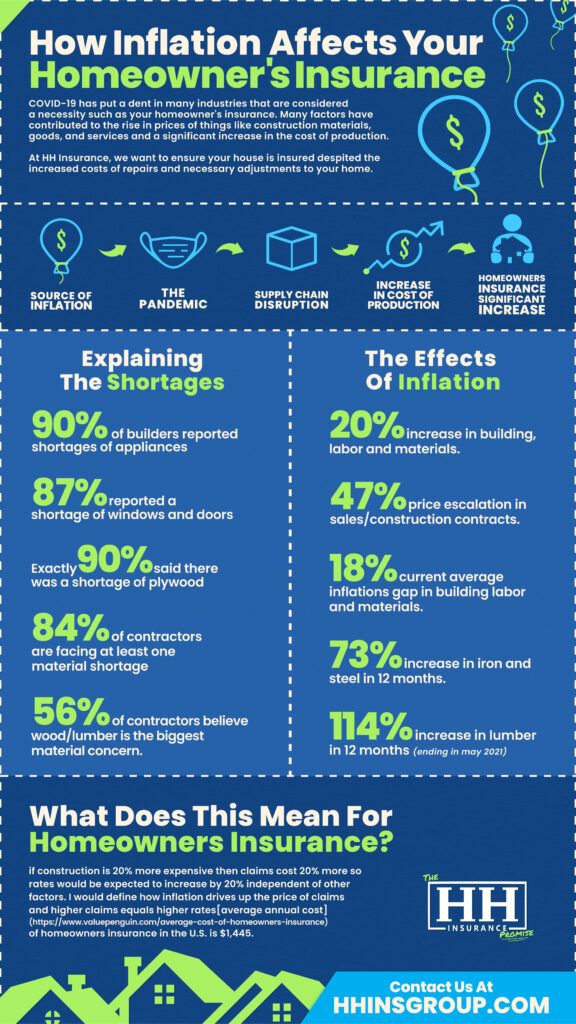

Explaining the Shortages:

- 90% of builds reported shortages of appliances

- 87% reported a shortage of windows and doors

- 90% said there was a shortage of plywood

The Effects of Inflation:

- 20% increase in building, labor, and materials

- 47% price escalation in sales/construction contracts

- 18% current average inflation gap in building labor and materials

- 73% increase in iron and steel

- 114% increase in lumber in 12 months

- 75% increase in the cost of steel mill products

- 15% increase in asphalt, tar roofing, and siding products

Throughout the pandemic, the construction industry has been deeply impacted from all angles. The increase of material prices and production costs, in addition to supply chain shortage, are impacting consumers directly.

How Much is My Home Insurance Increasing?

These shortages are not only affecting the cost to build new homes. But more importantly, has sent the cost to repair and maintain a home surging. Though claim frequency has decreased, the amount paid per claim has increased significantly, due to inflated building costs.

To account for these projected increases, insurance companies raise their rates, passing the financial burden onto the homeowner. It’s difficult to state exactly how much it has and will increase, but the belief is that as construction materials and labor pricing escalate, the claim amount will rise with building costs accordingly.

Nevertheless, you won’t see an immediate increase in the rates because your policy is issued on an annual, 12-month basis. Meaning you likely will not see an impact on your rate until that policy renews. Stay ahead of the inevitable, as one of our HH Insurance clients, the home insurance Florida team will review your policy and continue our efforts to provide the ideal coverage for you and your family at the right price.

HH Insurance Will Keep Its Promises

Insurance companies from around the country have continued to adjust their policies based on the current economic trends. HH Insurance home insurance Florida has gone above and beyond to keep your homeowner’s insurance at a fair rate.

With over 200 years of experience, HH Insurance offers the best homeowners insurance Tampa. Even when insurance prices rise due to inflation, we can make a policy that suits your needs and budget. Our agents focus on providing exceptional financial advice when it comes to your homeowner’s insurance.

We are committed to protecting your home and family while also protecting your pocket. No matter how much of an impact inflation has, we are devoted to offering the best homeowner’s insurance rate in Tampa FL. Regardless of the nationwide inflation, or your insurance type or coverage, HH Insurance Tampa homeowner’s insurance is always examining rate options and providing our clients with solutions to protect their families and home. Our promise is to change the stereotype of insurance companies in Florida, and we will continue fulfilling that promise despite the current inflation trends.

**This blog provides a brief overview of the terms and phrases used within the insurance industry. These definitions are not applicable in all states or for all insurance and financial products. This is not an insurance contract. Other terms, conditions and exclusions apply. Please read your official policy for full details about coverage. These definitions do not alter or modify the terms of any insurance contract.